All Categories

Featured

Table of Contents

With certified financier requirements, investors are avoided from spending past their ways. If a bad financial investment decision is made, in theory a certified investor has higher financial methods to take in the losses. Unregistered private safety and securities might have liquidity limitations; such safety and securities may not be able to be offered for a period of time.

Investors need to represent their funds honestly to companies of safety and securities. If an investor says they are a certified capitalist when they aren't, the economic firm can decline to offer securities to them. Understanding what certifies a capitalist as accredited is critical for establishing what sorts of protections you can invest in.

Renowned Accredited Investor Investment Funds

The demands also promote advancement and progress via extra financial investment. In spite of being accredited, all capitalists still need to do their due persistance during the procedure of investing. 1031 Crowdfunding is a leading realty financial investment system - accredited investor syndication deals for different financial investment cars mainly available to certified financiers. Accredited capitalists can access our selection of vetted investment possibilities.

With over $1.1 billion in safety and securities sold, the monitoring team at 1031 Crowdfunding has experience with a wide variety of financial investment frameworks. To access our total offerings, register for an investor account.

PeerStreet's goal is to level the having fun area and allow people to accessibility genuine estate financial debt as an asset course. Because of governing needs, we are required to comply with the SEC's plans and permit only accredited capitalists on our system. To much better educate our capitalists regarding what this implies and why, reviewed below to discover these government laws.

Approved investors and accredited financier systems are deemed a lot more innovative, efficient in tackling the danger that some protections offer. This policy likewise applies to entities, that include, financial institutions, partnerships, companies, nonprofits and counts on. PeerStreet is taken into consideration a "exclusive placement" investment opportunity, unlike government bonds, and thus based on somewhat various federal policies.

Expert Passive Income For Accredited Investors

These governing requirements have origins that go much back into the advancement of America's financial industry. The Securities Act of 1933, just four years after the supply market accident of 1929 and in the thick of the Great Depression, made certain terms concerning exactly how safety and securities are sold.

If you're aiming to construct and diversify your investment portfolio, take into consideration investments from commercial realty to farmland, red wine or art - accredited investor platforms. As an approved financier, you have the chance to assign a portion of your profile to more speculative possession courses that offer diversity and the potential for high returns

See All 22 Items If you're an accredited capitalist looking for brand-new possibilities, consider the adhering to varied financial investment. Yieldstreet concentrates on investments in realty, legal settlements, art, financial tools and delivery vessels. Yieldstreet is just one of the very best real estate investing applications for those thinking about actual estate and different investments who have a high internet worth, with offerings for certified and nonaccredited capitalists.

Masterworks allows investors to own fractional shares of great art. Masterworks offers you the alternative to expand your portfolio and invest in excellent art work while potentially gaining revenues from 8% to 30% or more.

World-Class Accredited Investor Real Estate Deals for Accredited Investor Opportunities

This possibility comes with all the benefits of other alt investments on the checklist, such as expanding your portfolio to protect versus supply market volatility. Vinovest has revealed earnings of 10% to 13% annually in the past.

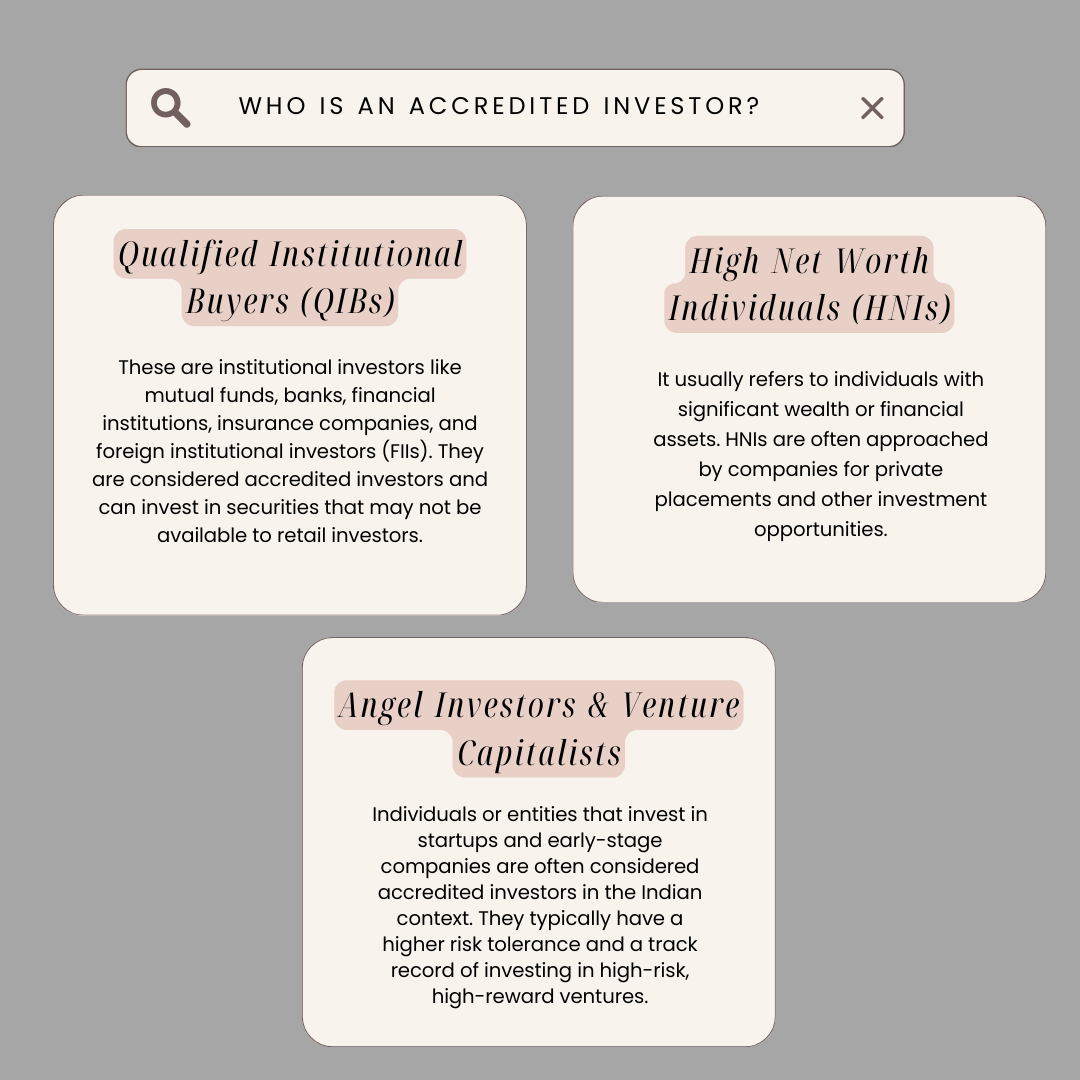

A recognized financier has a special standing under economic policy legislations. Each nation defines certain requirements and guidelines to qualify as a certified investor.

For instance, accredited investors in the united state must please a minimum of one requirement concerning their total assets or income, property size, governance status or expert experience. This requirement consists of high-net-worth individuals (HNWIs), brokers, counts on, financial institutions and insurance provider. The U.S. Stocks and Exchange Commission (SEC) defines the term approved investor under Policy D.

The idea of assigning accredited investors is that these individuals are thought about economically advanced sufficient to bear the threats. Sellers of non listed securities may only market to certified capitalists. Non listed safeties are inherently riskier since they aren't required to supply the regular disclosures of SEC enrollment. To come to be a certified investor as a specific, you must fulfill revenue or net worth requirements, such as a typical annual revenue over $200,000 or $300,000 with a partner or domestic partner.

Esteemed Accredited Investor Investment Networks

A number of financial investment choices for certified investors, from crowdfunding and REITs to hard cash finances. Below's what you can consider. Crowdfunding is a financial investment chance expanding in appeal in which a business, specific or task looks for to elevate necessary capital online.

The function of the syndicator is to scout and protect residential or commercial properties, manage them, and attach investment agreements or set investors. This procedure simplifies property investment while offering accredited financiers outstanding financial investment opportunities. REITs swimming pool and oversee funds invested in various realty properties or real-estate-related tasks such as home loans.

Table of Contents

Latest Posts

Tax Lien Investing 101

Buying Homes For Back Taxes

Tax Lien Investment Bible

More

Latest Posts

Tax Lien Investing 101

Buying Homes For Back Taxes

Tax Lien Investment Bible